Michigan Financial Advisor Steven Drahozal

There are many fine men and women out there who are Michigan Financial Advisors and in the business of wealth management, retirement planning, or financial services. They probably do well for themselves and the bank, broker, or insurance company they represent. They are not Steven Drahozal

I work for you

I believe that I am responsible for holding the dreams of other people in my hands. It gives me purpose. And the results have been fantastic. I have:

- Helped people retire sooner than they expected.

- Provided my clients with an inflation-protected lifetime income plan.

- Supplemented Social Security and pensions with guaranteed lifetime income.

- Shown people ways to increase income without increasing taxes.

- Reduced fees paid to other financial professionals.

- Provided each client with a written and understandable retirement plan, crafted to serve their life goals.

Who I Serve

I help many different kinds of clients, but I find that my services are best suited for people at or nearing retirement, generally 55 to 75 years old. My clients include:

- Affluent entrepreneurs who are serious about long-term financial planning with a retirement focus.

- Clients of existing Michigan Financial Advisors who want an objective second opinion to ensure they’re optimally managing their retirement income and/or growth potential with their retirement savings.

- People who manage their own investments but were unsure about the next step in financially preparing for retirement.

- People who are serious about getting help and taking action to achieve a financially independent retirement.

- People who have investable assets of $500,000 or more.

- Current Customers.

How I Can Help You

Retire Early

Using our proprietary Retire Now Software, I can produce a unique Income For Life Report to help determine if you can retire now or not and how.

Retire In Style

Retire into the lifestyle you want on your terms with ample guaranteed lifetime income to live and travel the way you want.

Fee Reduction

Let me help you understand and possibly minimize the fees you are paying to have your portfolio managed.

Risk Mitigation

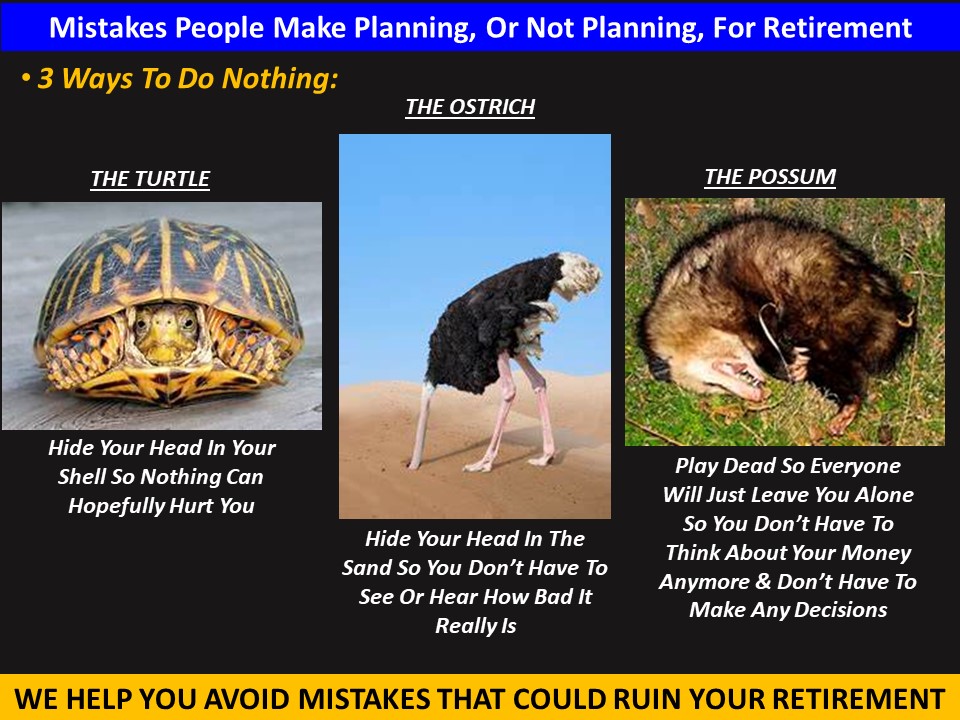

You do not need to have your money in the stock market to have a successful retirement. I look at risk differently than most of my competitors.

REQUEST YOUR PERSONAL COMPLIMENTARY FINANCIAL REVIEW WITH STEVEN DRAHOZAL

Who I do not work for:

There are some people that I have found are not a good fit for what I do. If you:

- Want to manage your own money.

- Enjoy the thrill of risk-taking.

- Like worrying about what's happening on Wall Street.

Then, I am not your guy.

Retirement planning starts Here

My top priority is to help you stop worrying about your money. I believe it’s time for a new approach to retirement planning. That’s why we use the Retire Now software with two main goals of:

- Make sure you never suffer a big loss like 2008 ever again.

- Make sure your income is dependable and predictable to last for as long as you live.

Start working towards your Financial Freedom Today

I am a Michigan Financial Advisor who specializes in designing customized retirement income plans to help bring you financial freedom, and a retirement income to last a lifetime. I use conservative, risk reduction strategies to protect your retirement savings from market instability and provide the opportunity for portfolio growth. I prefer to plan for the worst, while hoping for the best.

REQUEST YOUR PERSONAL COMPLIMENTARY FINANCIAL REVIEW WITH STEVEN DRAHOZAL

My entire process is focused on you.

My entire process is focused on delivering you a Comprehensive Written Retirement Income Plan. A written plan can be used as a measuring stick to track proper progress, and explain every detail of your plan for retirement success. Having a written financial plan will help you avoid confusion, mistakes, and misunderstanding and will significantly improve the probability of a successful retirement plan.

I can help you with your Questions, Concerns, or Fears

If you are a retiree or retiring soon, my focus as an independent Michigan Financial Advisor is to:

- find out about you, or you and your spouse.

- discuss your current financial position.

- ask questions about your life goals, needs, and objectives, and what you are trying to achieve.

- educate you on multiple subjects and alternatives.

- create a customized written comprehensive retirement plan.

- estimate income tax scenarios that meet your goals.

- establish the best ways to pass your assets on to your beneficiaries.

- implement your plan.

- do all of the paperwork.

- and meet with you in the future to review the progress of your plan.

This is why I formed the Mature American Planning Company 25 years ago and, more recently, founded the Wealth & Income Management Group. Between them, I can provide an unparalleled level of service, commitment, and dedication to your success. That is what retirees and the soon-to-be-retirees need to succeed financially. I will do everything I can to ensure your financial security throughout your retirement.

I AM A SMALL BUSINESS OWNER AND I RUN AN INSURANCE AGENCY

Wealth & Income Management Group

Mature American Planning Company

I can help You Plan for Retirement

Do you know exactly how much money it is going to take for you to be able to retire and then to stay happily retired? If your answer is “no,” would you like me to help you figure out how much money you need to retire.

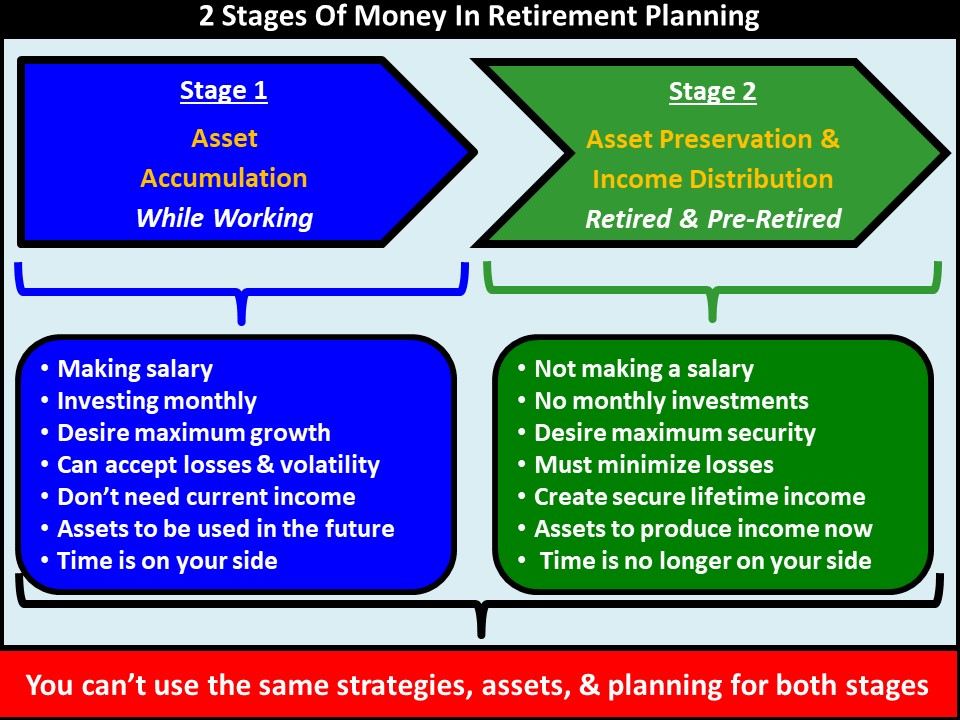

When you are no longer getting a salary

You probably recognize that the investment strategies used to manage wealth during your working years are very different from the retirement lifestyle plan needed to properly distribute income during your entire retirement. By attending dinner seminars, or through your own personal research, you may have discovered there is a lot of misinformation out there. You probably have a retirement lifestyle in mind, but you need help to make it happen. Let's make a plan.

A Unique Approach

What I have to say will most likely sound different, possibly even opposite of what other Financial Advisors have recommended to you. I am going to tell you to use your assets to create the maximum amount of Guaranteed Lifetime Income, and then you decide if you want to spend the money, give some of the money away, and/or save some of the money.

REQUEST YOUR PERSONAL COMPLIMENTARY FINANCIAL REVIEW WITH STEVEN DRAHOZAL

It starts with, What’s important about Money to You?

Many of my clients have worked thirty to forty years, sometimes two or three jobs, to get where they are today. They want to enjoy their retirement. They want to go out to eat, do some traveling and also spend time with their friends and family. Retirees don’t want to be concerned about another market downturn like the one in 2008 or 2020. Also, they don't want to worry that someone on Wall Street may control their retirement.

No Do-Overs or Second Chances

There are no do-overs or second chances in retirement. My number one priority is to help you plan for retirement and arrange the income plan you need for the rest of your life. I would like to put together a written retirement plan so you can enjoy your retirement lifestyle. Together, we can discuss ways that may transform your savings from that thirty to forty years or more of savings, into an income plan that could last for the rest of your life.

Conclusion:

I take care of a variety of clients, but I have found that my services are best suited for people at or near retirement. As an independent Michigan Financial Advisor, I can work with you to find you quality solutions to meet your goals, needs, and objectives. Let's discuss your ideal retirement lifestyle.

Finally

If we haven't already met, please schedule a time on the Steven Drahozal online calendar for an introductory phone call. I will treat you politely and like a professional. As a result, what we do after the initial call is up to you. Let's make a plan together. If you are at or near retirement and you have some questions or need a little guidance, feel free to contact me. I know retirement planning can be confusing, so it is important to get the facts before you make any long-term decision.

REQUEST YOUR PERSONAL COMPLIMENTARY FINANCIAL REVIEW WITH STEVEN DRAHOZAL

Recent Articles

Reprinted with Permission from Ed Slott and Company, LLC – April 2, 2025

Higher IRA Federal Bankruptcy IRA Protection Limit Became Effective on April 1 By Ian Berger, JD When you file for […]

IRA Trivia: Missed RMD or Excess Contribution

Here is an all-too-common situation that seems counterintuitive: A participant in a 401(k) retires and must take his required minimum […]

How Roth IRA Distributions Are Taxed

Do you have a Roth IRA? If you do, there will very likely come a time when you want to take […]